O'Dowd Politics

A call for pragmatism in politics.

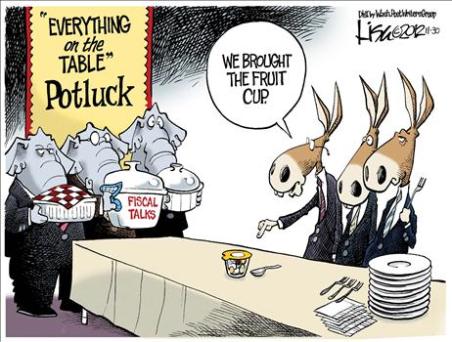

Archive for the tag “fiscal cliff”

Promises Schwamises. Do the Right Thing Boehner!

Grover Norquist ruined our Republican caucus. Enough said. Now I know that some of you will immediately de-follow this blog and burn an effigy of my likeness but perhaps a few of you will read through to the end and understand exactly what my position is. First of all, Republicans don’t run the country. I know this may be a shock to those of you who failed high school civics but there are three branches of government and two of them are responsible for creating laws (Executive and Legislative). Of these two, there are three centers of power: the Senate, the House, and the President. All of these are required to pass a law (unless of course a supermajority can be secured in Congress which is going to happen at about the same time as when we establish a colony on Alpha Centauri). Now consider that Republicans only have one of these three centers of power in the lawmaking process–that’s right; Republicans are beholding to Democrats to achieve anything at all.

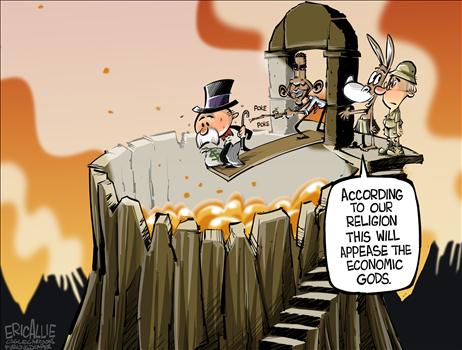

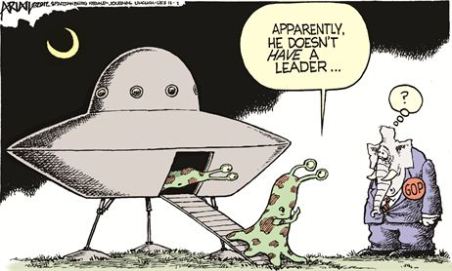

Now look back all of eight months to the Republican primary where in the MSNBC debate, all eight elephants on the stage agreed that they would not increase taxes at all. Even, as it was proposed by the moderator, if tax hikes occurred on a 1 to 10 ratio with budget cuts (raise taxes and cut the federal budget by ten times that much). This would have been an excellent opportunity for one of the field to demonstrate real leadership but since most of them had signed the Grover Norquist “no new taxes pledge”, they were trapped into looking hardheaded and as nonnegotiable as a three-dollar bill with Clinton’s name on it. Pragmatic? No. Dumb? Yep!

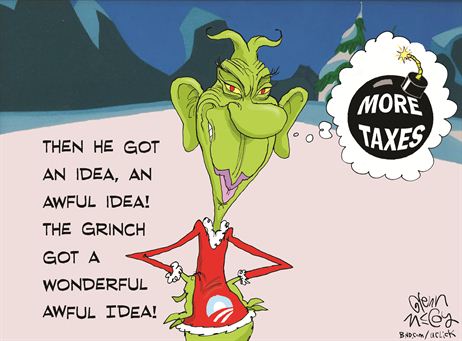

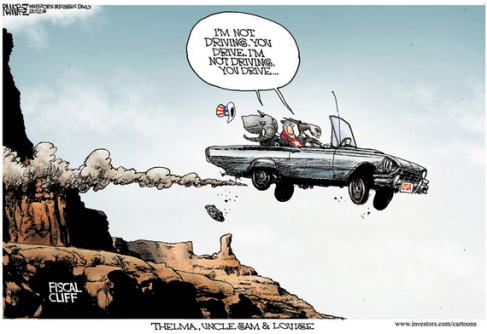

Look, I’m not saying that tax increases are the answer; I believe that the federal government is way too big and that it is high time to skinny up Uncle Sam who is currently the unwitting mascot for the First Lady’s “Let’s Move” campaign. In spite of these emphatic beliefs, I also believe in pragmatic governance which is exactly the opposite of John Boehner’s $800 billion answer to the fiscal cliff crisis which can be summed up as follows:

“House Republicans have prepared their excellent and thoughtful response to the crisis that holds our economy in hostage. We are asking the Senate and the President to raise taxes in strange and unexplainable areas without raising taxes at all.” –John Boehner

Intriguing. That’s like burning down your house without burning down your house. I know that these Republicans are really struggling with how to break a promise without breaking it but seriously? If you’re going to break it then at least break it in a way that is good for somebody! The $800 billion broken-promise-that-wasn’t did little to solve the problem and only served to deepen the public’s perception that the elephants are in the pockets of the top 1%. It would have been better to say they would provide no additional revenue and that Obama and the donkeys could just pound sand right after decreasing the size of the government.

Here’s the reality of the situation: Obama’s holding the trump of the trump cards because if the cliff happens he gets everything he wants and can propose to permanently lower taxes for the 98% right after the country takes the plunge. In that event he looks like the hero and the Republicans get smashed for not being reasonable about their compromise. Not good.

Here’s what Republicans should do: Axe the promise to Norquist and explain to their constituents that it was a dumb idea to sign something that left them no room to compromise. Sure, the tea party conservatives and most of the rest of us won’t be happy, but this isn’t 2010 and pragmatism is now in-vogue. This is an opportunity for Republicans to both stand on principles and make up lost ground with moderates, the middle class, and the rest of America that doesn’t often dine at the Four Seasons. Remember that a promise that shouldn’t have been made shouldn’t be kept and that you should always trade a buck for a crisp ten dollar bill. Ten-to-one isn’t all bad. Back to the negotiating table people!

O’Dowd

Should Citizenship be Free?

The title of the post probably harkens up thoughts of immigrants sailing into New York harbor or perhaps visions of Mexican immigrants pouring over our southern border. My intention however is to consider whether or not people who live in the greatest country on earth, and who benefit every day from the privileges that millions of men and women only dream to enjoy, should be able to live with no personal contribution to the government that protects their life, liberty, and prosperity every day. Recent studies have shown that 45% of individuals who filed taxes payed not one dime to the federal coffers. Conservatives like me may think “Great! At least someone wasn’t robbed blind by Uncle Sam.” I beg to differ.

There is a legitimate purpose for government and we all, regardless of political views or party, recognize that freedom isn’t free and that the federal government is necessary to protect us from those who would do us wrong. In my view, the proper role of government doesn’t stop there–Washington has a role to play, as is outlined in the Constitution, in commerce, promoting science and research, the post office and roads, and a variety of other duties that we take for granted every day. Without the government in its proper role, there would be anarchy, we would have no economic system, and the strong would lord over the weak. Do we need a well-funded federal government? Absolutely. Now back to my question: should citizenship be free? Absolutely not.

One of the major reasons we are in this fiscal mess is the law of givers and takers. If the taker can require the giver to give, then the taker will always take until the giver has nothing more to give. To make matters worse, when takers outnumber the givers, the giver will be exhausted of resources much faster and there will be nothing but poverty throughout our land. Today we are not quite there. 45% of taxpayers are takers and 55% are givers although this doesn’t account for the many who do not file taxes. This must change.

We can argue and debate about what the percentage needs to be for each tax bracket, and how much more the rich should pay than the poor but I have a simpler solution and one that will go along way toward achieving a balanced budget in this country–ensure that everyone, including my friends who are poor and who gain thousands of dollars a year from Uncle Sam simply because they have children, pay at least $1 no matter how small their income is. If everyone is a giver, and nobody is mooching at tax time, we will have a much better outlook on our country’s balance sheet.

Today a dollar isn’t much. You can buy a large soda or a king-sized candy bar for a dollar or go to the 99 cent store and load up on tons of junk but how much is your freedom worth? Go ask the Jews who lived in Nazi Germany or even those who lived in slavery in our country’s darker times–I’d bet a dollar that they’d trade you that candy bar for their freedom any day, and twice on Sunday.

O’Dowd